Quick Read Summary

The role of BDRs and SDRs is evolving, shaped by advances in AI, buyer behavior, and the need for more strategic engagement. While AI has introduced automation for tasks like email writing and initial prospect outreach, it is enhancing rather than replacing BDR functions. Already, 60% of BDRs are using AI tools and most see these technologies as valuable aids that improve efficiency without eliminating the role of human interaction.

Despite ongoing speculation about AI’s impact, the BDR role remains strong and well-supported. 58% of BDR teams have expanded over the past year, and performance remains steady, with BDRs achieving 88% of their quotas on average. Success in 2025 will rely on strategic engagement strategies, not simply persistence—BDRs who multi-thread effectively (engaging multiple stakeholders within an account) outperform those who don’t. At the same time, buyers continue to delay direct interactions, reinforcing the importance of value-led outreach over aggressive meeting requests.

This report examines how AI, multi-threading, and evolving buyer expectations are shaping the BDR role, highlighting best practices that drive success in today’s sales environment.

Summary of Findings

- The majority (79%) of BDR organizations have either grown or maintained their size.

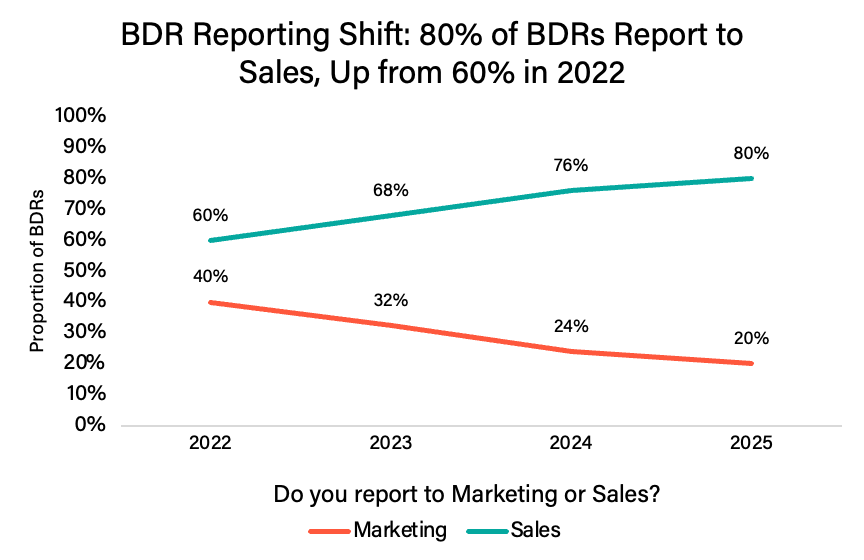

- Most BDRs (80%) report to the sales department, while the remaining report to Marketing.

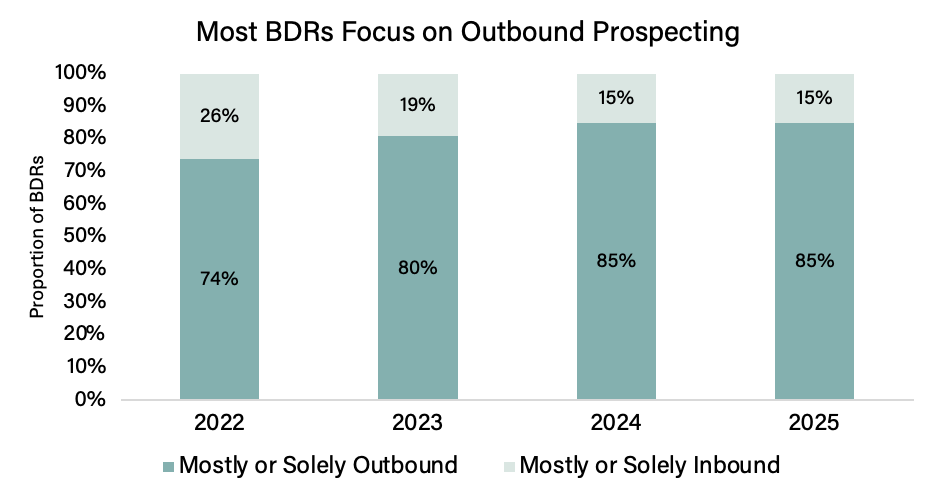

- 85% of BDRs primarily or exclusively focus on outbound activities.

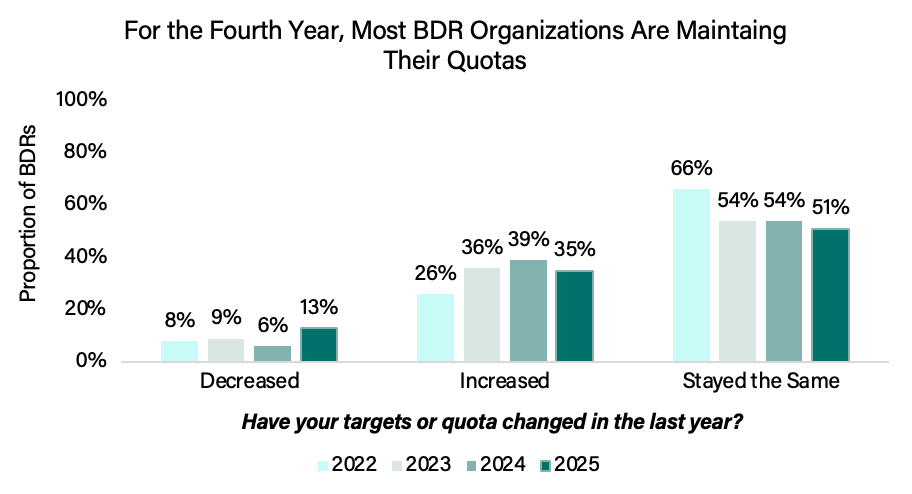

- Roughly half of companies maintained their quotas (51%) from last year, 35% raised them, and 14% lowered them.

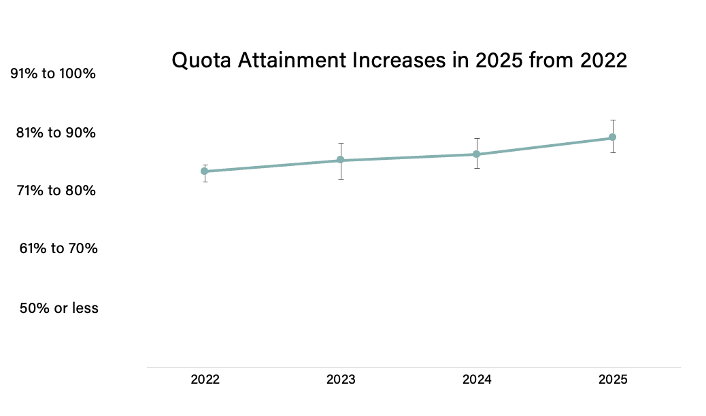

- BDRs maintained their performance, achieving approximately 88% of their quota, similar to last year’s figures.

- Last year, 83% of BDRs said they engage in multithreading. This year 90% do. They also reach out to more contacts – an average of 9 individuals compared to 6.4 last year.

- There is a slight positive correlation between deal size and the number of contact attempts by BDRs, presenting an opportunity for organizations targeting smaller deals to be more efficient.

- 82% of BDRs indicate making the same or more attempts to engage with multithreaded contacts (compared to 75% last year).

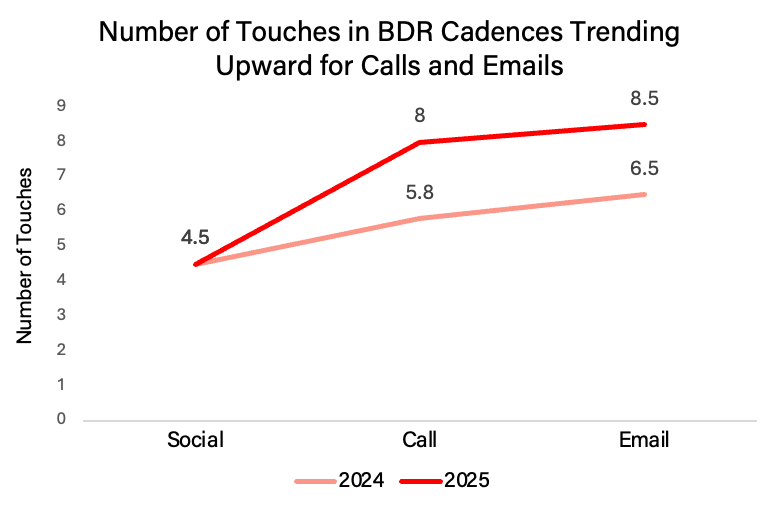

- BDRs typically make about 21 attempts per contact (compared to 17 last year), with about 5 of them being made on social, 8 being made via calls, and 8 made over email.

- The average BDR gives up and moves on after a 53-day cadence.

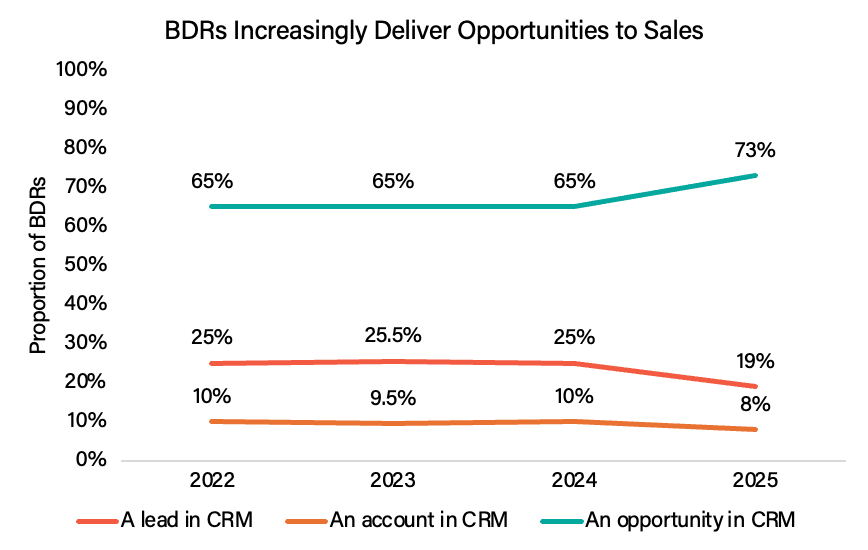

- When BDRs have completed their work with a sales-ready prospect, approximately 74% are handing it over as an Opportunity to sales rather than a Lead or Account.

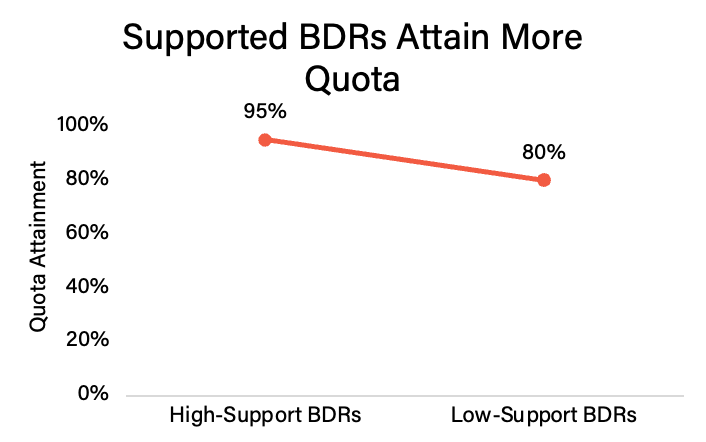

- For the fourth consecutive year, BDRs who feel supported achieve higher quotas than those who do not (95% of quota versus 80% of quota).

- After a decline in 2024, BDRs’ sense of support in their roles has stabilized.

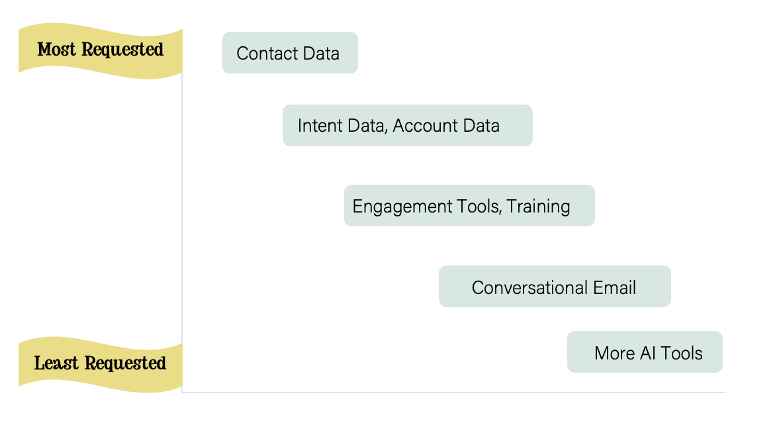

- Contact data is the most requested resource among BDRs to help them feel more equipped to meet expectations, followed by an equal split between intent and account data.

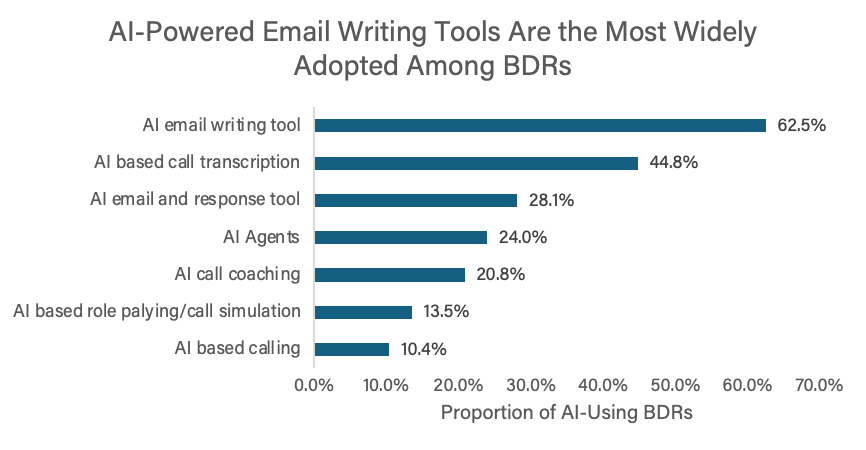

- Among BDRs using AI, call transcription and email writing tools are the most utilized for the second year in a row.

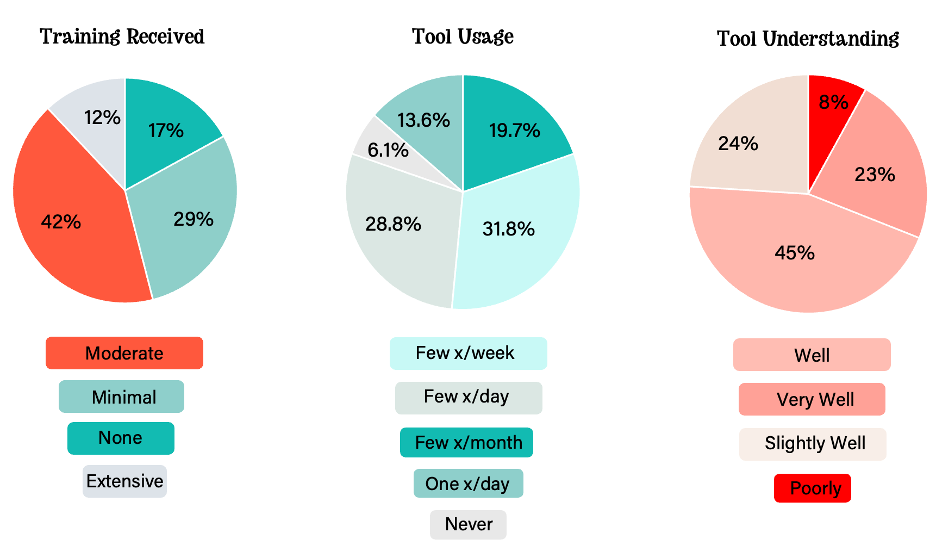

- A majority of BDRs receive minimal to moderate training on the AI tools they use, similar to last year.

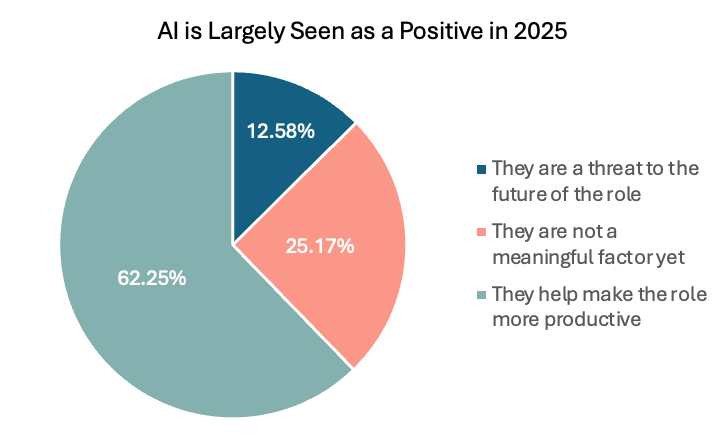

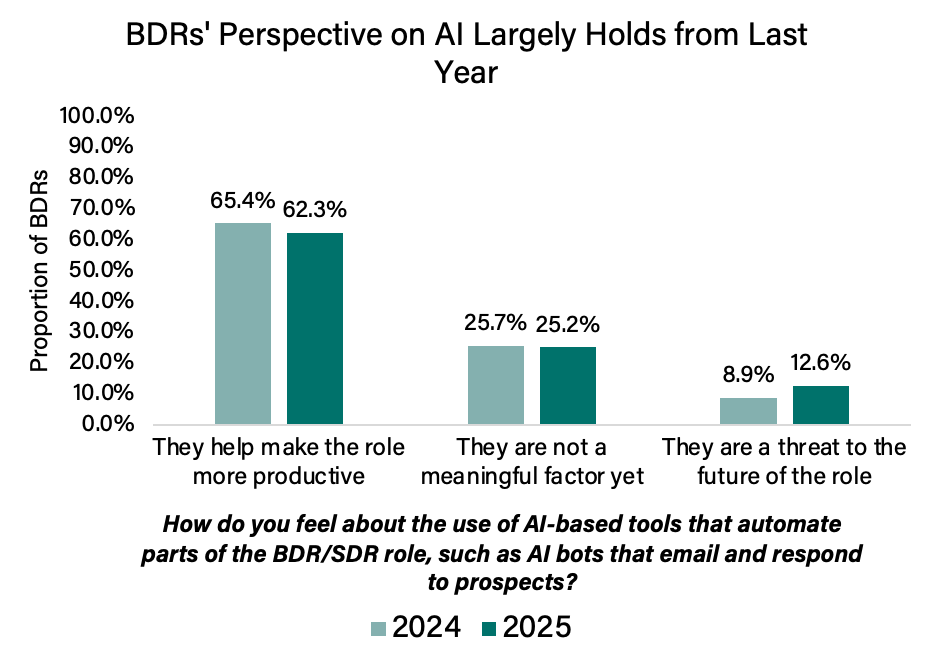

- Like last year, BDRs generally view AI tools positively, with 62% (65% last year) believing they enhance productivity, while 13% (9% last year) perceive them as a threat to the future of their role.

About the Report

This report is based on the survey responses of 262 BDRs and is organized into four main sections.

- The Scope of the BDR Role – Exploring the responsibilities of BDRs and current state of BDR teams, including whether their teams are growing or shrinking.

- BDR Performance – Assessing expectations for BDRs and evaluating their success in meeting quotas and performance goals.

- BDR Sentiments – Exploring how BDRs feel about their roles, challenges, and career aspirations.

- Artificial intelligence (AI) – Investigating how BDRs are using AI tools and their attitudes toward this technology.

- Implications – What does it all mean?

Where appropriate, we compare BDRs’ feedback about their roles this year with responses from previous years.

Introduction

BDRs (Business Development Representatives) and SDRs (Sales Development Representatives) have long served as the initial point of contact between providers and their potential buyers. Traditionally, this involved high-volume calling and emailing, where volume of effort, rather than insight-informed action, was the primary driver of success.

The brute-force methods are time-consuming, buyer-alienating, and yield low response rates. The brute-force method is and was unpleasant to do and to be on the receiving end of.

The rapid evolution of AI has introduced tools capable of identifying where efforts are likely to be most effective, and, more recently, of handling tasks once thought to require a human touch. Features like automated email follow-ups, advanced prospect scoring, and even AI calling agents have fueled speculation about whether AI could eventually replace the BDR function altogether.

However, this year’s study finds that just about 60% reported that their organizations have adopted at least one AI tool, but many emphasized that these tools act as aids rather than replacements.

In this report, we examine the current landscape of the BDR role, exploring the impact of AI, the evolving expectations placed on BDRs, and the opportunities and challenges they face in today’s fast-paced sales environment.

The Scope of the BDR Role

Teams Are Growing or Holding Steady

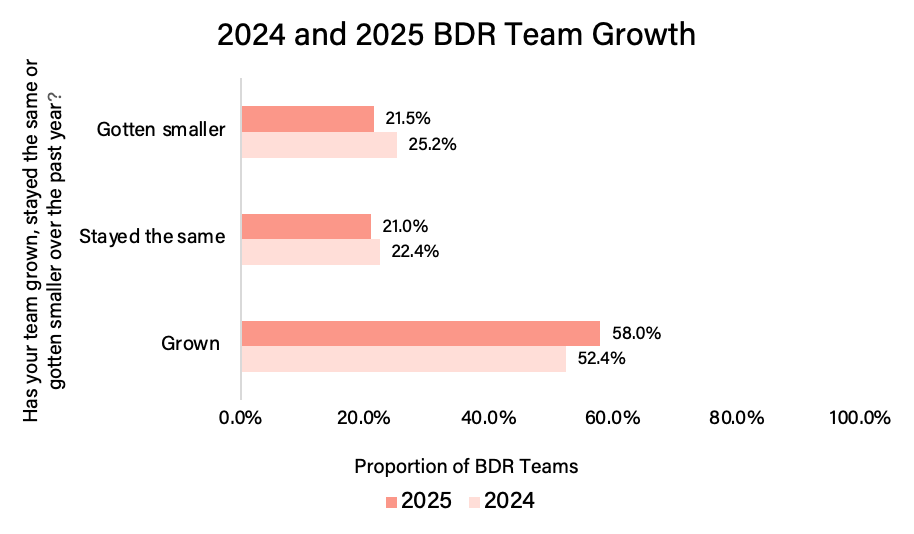

Like last year, most BDR teams are maintaining their size or expanding, with nearly 20% downsizing. In 2024, 75% of BDRs we spoke to reported that their teams had either stayed the same (22.4% of teams) or grown (54.2% of teams) since the year prior. This year, a similar 79% said their teams have maintained or increased in size, with 58% reporting growth from 2024 to 2025.

AI is not replacing roles—teams that have adopted AI are expanding at the same rate as those that have not.

Most BDR/SDRs Now Report to Sales

Since 2022, we’ve seen a steady increase in the percentage of BDRs reporting to Sales. In 2022, 60% reported to Sales, growing to 68% in 2023, 76% in 2024, and reaching 80% in 2025.

BDRs Overwhelmingly Perform Outbound Motions

Since 2022, the majority of BDRs have reported that outbound prospecting has been their primary focus.

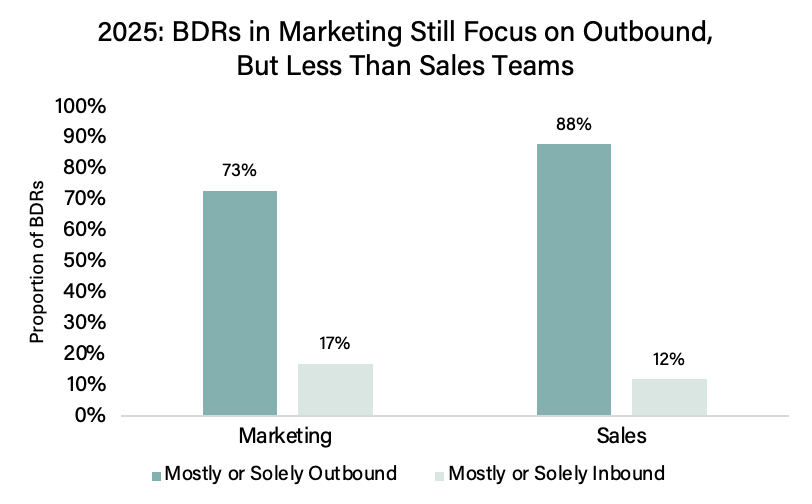

If BDRs report to Marketing, they are still overwhelmingly likely to be focused on outbound activities, though that number (73%) is substantially lower than for BDRs reporting to Sales (88%).

Job Tenure: BDRs are Staying in Their Roles Longer

Each year, we ask BDRs how long they’ve been in their role as a BDR for their current company and how long they’ve been in the BDR role across all organizations they’ve worked for. In the chart below, there is a statistically reliable difference in both current job tenure and total BDR tenure between 2022 and 2025. While the difference is modest—about 3 to 4 months longer on average—it reflects a notable trend of BDRs remaining in their roles longer. This likely reflects a slowing job market in more senior revenue team positions.

BDR roles are popular starting points for early sales professionals, providing hands-on experience with sales processes, customer engagement, and collaboration with account executives. These roles help new professionals develop foundational skills like prospecting, lead qualification, and outreach. We explored the number of BDRs in their first professional role in this field.

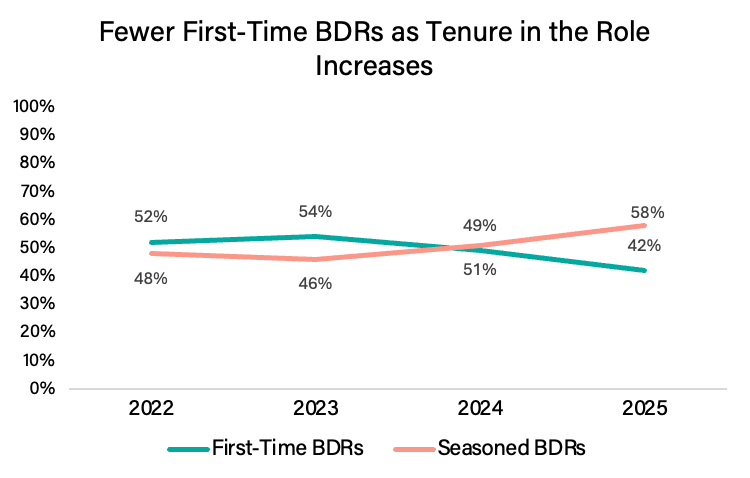

The differences in the chart above do not meet the typical standard for statistical reliability, despite there being a 16-percentage point difference in the number of first-timers versus veterans in 2025. This suggests that while BDRs are staying in their jobs longer, there is a lot of variation in our sample. This aligns with our earlier finding that BDR tenures are growing. On average, BDR tenure is 15 months for those in their first role and 31 months for those with experience in multiple roles.

BDRs in their first role report similar levels of quota attainment as their more experienced counterparts. They also engage in the same operational procedures in the role, such as the number of touches (email, phone, social) in their typical cadence per lead before moving on.

When experience does not result in performance improvement, that may indicate that BDRs (and their leaders) are not extracting productive learning from experience. In other words, they may not be focused on the things that truly matter for driving performance.

Career Aspirations

As in previous years, most BDRs view their current role as a steppingstone toward a future career in sales.

BDR Training

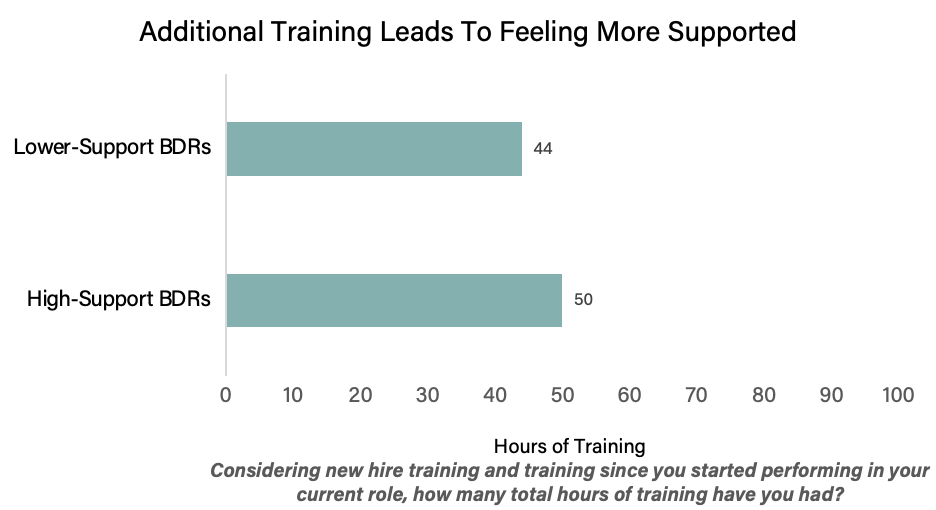

Because the BDR role is often a young professional’s first step into sales, on-the-job training can be pivotal to their success in the role. We asked BDRs how many hours of training they received, including both new hire onboarding and ongoing training after starting the role. Unsurprisingly, there was a wide range, from as little as 2 hours to as much as 100 hours. On average, BDRs reported receiving approximately 47 hours of training—or, just over a week, with half of BDRs report more than 40 and half reporting less than 40 hours of training.

Does Training Translate to Outcomes?

We found a modest but statistically reliable correlation between the number of training hours and BDRs’ quota attainment. BDRs who spent more time in training tended to achieve slightly higher levels of quota attainment. Additionally, BDRs that reported receiving an average of 6 more hours—roughly an extra day—of training, reported feeling more supported in their roles than those who received less training. And as we discuss below, BDRs who feel more supported achieve higher quota attainment than those who do not feel as supported. It seems that training plays both a direct and indirect role in driving outcomes in the BDR role.

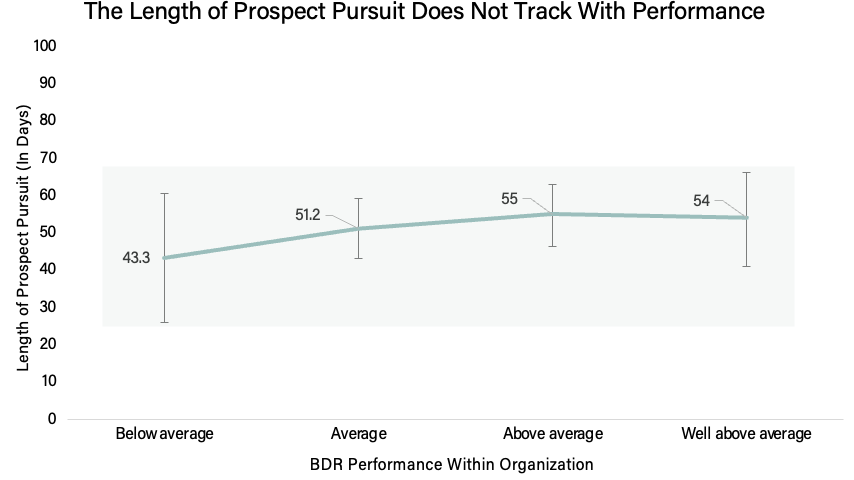

Length of Prospect Pursuit

A common question among BDRs is how long they should follow up with a lead before deciding to move on. To address this, we asked BDRs how many days they typically pursue an account before concluding their efforts. BDRs reported spending 53 days following up with an account before moving on.

There is a modest but statistically reliable correlation between larger deal sizes and more days spent following up on an opportunity (r = .18). However, the number of days spent following up with an account is not reliably related to quota attainment or relative performance within a BDR organization compared to peers. While it makes sense that BDRs show more persistence when larger deals are at stake, this increased follow-up effort does not appear to translate into higher rates of quota attainment.

This suggests that the quality and timing of engagement may play a more critical role in achieving success than simply extending the follow-up timeline.

Inside the BDR Cadence

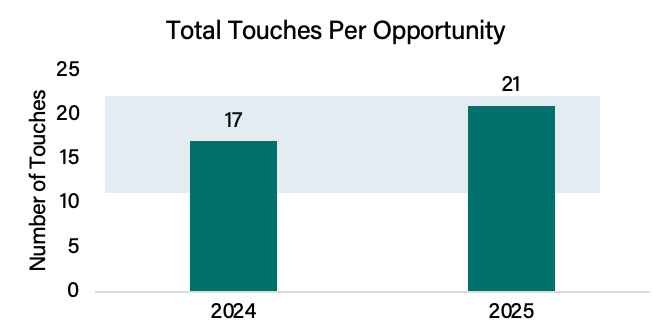

Last year, BDRs reported that they made about 17 attempts per contact with a relatively even spread among social touches, calls, and emails. Last year, BDRs made reliably more email than social attempts, though the difference was just two.

In 2025, BDRs report making an average of 21 attempts per contact. While this increase from 17 to 21 attempts is not statistically reliable due to high variability in responses last year, the trend suggests increased activity overall. Social touches remain consistent at 4.5 per contact, but BDRs report more calls (8 vs. 5.8) and emails (8.5 vs. 6.5). While the differences in calls and emails do not meet our typical 95% confidence standard, they are marginally reliable, with email touches reaching 92% confidence and call attempts at 90% confidence. This suggests a moderate likelihood that these increases reflect a real trend, though variability in last year’s data prevents us from confirming with full certainty.

One notable finding for 2025 is that BDRS are executing more email than social touches, mirroring the pattern we first observed in 2024 and again in 2025 where calls are statistically higher than social touches.

While year-over-year differences are not statistically reliable, the data point to a trend of BDRs focusing more on email and call attempts to reach their contacts.

We explored whether the trending increase in email and call touches this year was linked to AI adoption. However, both AI adopters and non-adopters reported statistically similar numbers of calls and email touches, indicating that the rise in outreach is not influenced by AI adoption.

Multi-Threading Is Rising

In B2B, the best practice for identifying sales-ready buying processes is to attempt to contact multiple individuals inside a prospect account before concluding that there is no opportunity present. This practice is commonly called multi-threading. Even when BDR activities are triggered by an inbound lead, follow-up on that lead should include reaching out to other individuals within the same account before concluding that there is no potential opportunity.

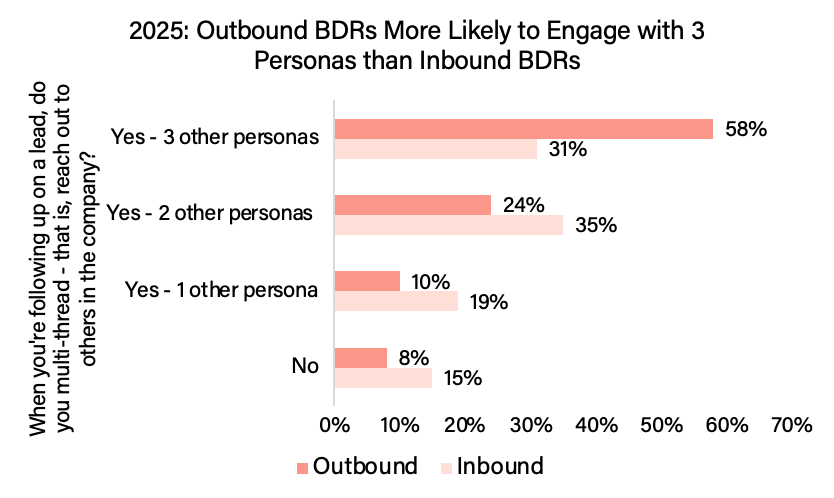

Last year, 83% of the BDRs we surveyed reported multi-threading. In 2025, that number has grown to 90%. Not only are more BDRs adopting this strategy, but they are also becoming more thorough in their efforts. In 2024, BDRs were most likely to follow up with just one additional persona, the majority in 2025 (53%) now report reaching out to three additional personas within the same account.

This shift is largely driven by outbound-focused BDRs, who are more likely to pursue three personas as part of their multi-threading strategy. However, inbound-focused BDRs are not far behind, with 31% reaching out to three personas and 35% contacting two personas within the same account.

These findings highlight a growing commitment to leveraging multi-threading across both inbound and outbound efforts.

BDRs are applying the same level of effort against the largest and smallest deals. This suggests an opportunity to better align multi-threading strategies with larger, high-value deals, where reaching out to additional personas could have a greater impact. By tailoring outreach efforts more strategically, BDRs may be able to maximize their influence and drive even greater success.

Contacts Attempted Per Opportunity

BDRs make 21 contact attempts per individual, and 90% reach out to at least one other persona (multi-threading), if not more. The number of individuals BDRs are attempting to engage has skyrocketed to nine contacts per opportunity—a statistically reliable increase compared to the previous three years. This means that, with nine individuals contacted per opportunity and 21 attempts per individual, BDRs are investing a total of 189 contact attempts per opportunity.

This represents a substantial commitment of time and effort.

While the overall average number of individuals BDRs reach out to per account is nine, we also looked at how many BDRs are engaging with more or fewer individuals than this average. Many reach out to five or fewer contacts per account.

What do the highest achieving BDRs do? We found that for BDRs achieving between 50% and 90% of their quotas are most likely to attempt five contacts per account. However, for the highest-performing group (those exceeding 100% of their quotas), the mode is 10 contacts per account.

The averages listed in the second column show statistically reliable differences across levels of quota attainment, indicating that higher-performing BDRs make more contact attempts than their lower-performing counterparts. Earlier in this report, we found that the number of days BDRs followed up with an account did not correlate with better performance. Together, these findings reinforce that success is not about how long BDRs persist but rather how effectively they execute their efforts. High-performing BDRs focus on reaching out to buying groups, strategically broadening their reach within accounts, instead of relying solely on longer sequences.

| Quota Attainment | Average | Mode (Most Frequent) |

| 50% or less | 7.5 | 5 |

| 61% to 70% | 5.3 | 5 |

| 71% to 80% | 8.8 | 5 |

| 81% to 90% | 10.1 | 5 |

| 91% to 100% | 9.6 | 5 |

| Over 100% | 10.1 | 10 |

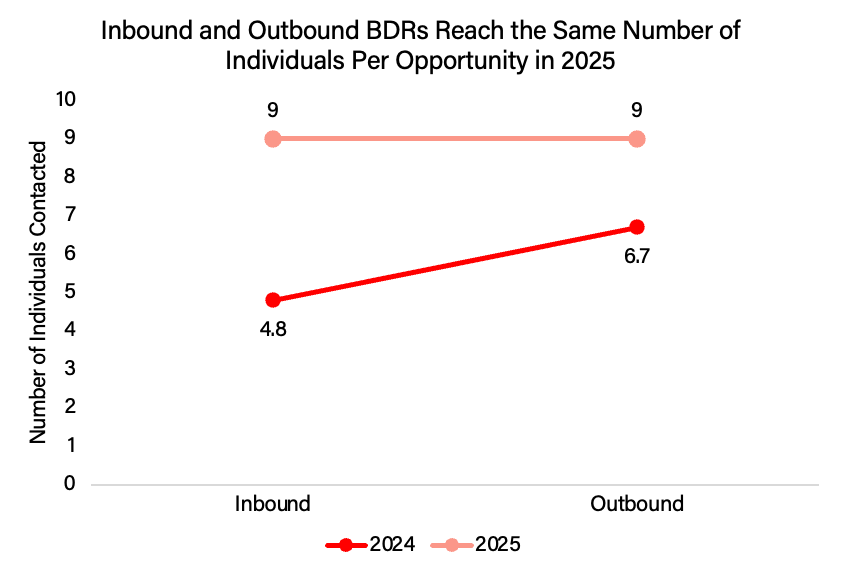

Inbound and Outbound BDRs Now Attempt to Reach the Same Number of Individuals Per Opportunity

A notable shift in 2025 is that inbound and outbound BDRs now report attempting to reach the same number of individuals per opportunity. In 2024, outbound BDRs reported targeting a statistically higher number of individuals compared to their inbound counterparts. This year, however, the gap has closed, with both groups reporting similar numbers—and an overall increase in the average number of individuals reached per opportunity compared to last year.

This reflects a more mature understanding of the process: prospects that are targeted via inbound marketing should be equivalent prospects to those identified via outbound, and they should receive same level of investment.

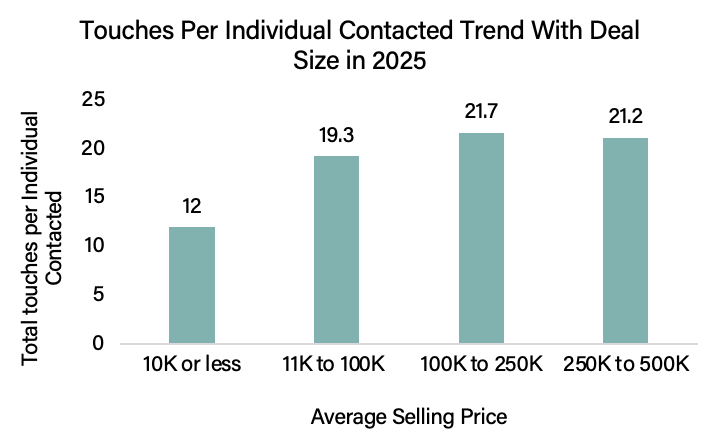

Contact Attempts Now Trend with Deal Size in 2025

Next, because we know that buying teams grow as deal sizes grow, we expected that deal size would influence the number of contacts a BDR attempts. It also stands to reason that when the potential pay-off for diligent prospecting is greater, the investment would also be greater.

Last year, we found no relationship between deal size and the number of contacts a BDR attempted. This year, however, the numbers are more encouraging (see the chart below).

While the only statistically reliable difference is between the smallest deal size group ($10K or less) and the largest ($250K to $500K), the trend is a marked improvement from last year’s scattershot results. It is worth noting that there are no statistically reliable differences between the $11K to $100K group and those above them, but the overall pattern suggests progress.

Similarly, the number of touches (calls, emails, social pushes) also trend in a direction where contacts associated with larger deals receive more outreach. Again, the differences shown in the chart below are not statistically reliable due to the high degree of variability between BDRs. We will continue monitoring this in the coming years.

BDRs Deliver Opportunities, Not Leads or Accounts to Sales

When BDRs have completed their work with a sales-ready prospect, 74% are handing over an opportunity to sales —rather than leads or accounts. This has largely been the case since we began asking BDRs in 2022. It is also highly consistent with the concept of multi-threading. When BDRs are identifying multiple buying group members, the opportunity object is the most appropriate CRM object to contain that intelligence.

While there is a slight uptick in the percentage of BDRs delivering opportunities in 2025, the increase is not statistically reliable. Even so, this trend remains a key metric we will continue to monitor in the future.

It is worth noting that both Inbound and Outbound BDRs deliver opportunities to sales, with figures remaining statistically consistent with what we found last year.

BDR Job Responsibilities

Time Spent Contacting Prospects

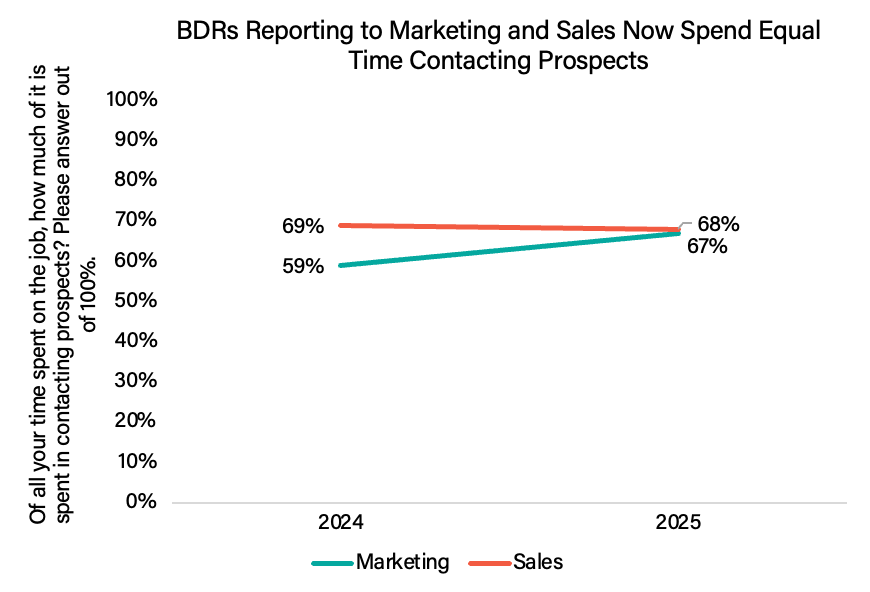

Like last year, BDRs spend about two-thirds (68%) of their time actively reaching out to prospects. There is no difference in time spent on outreach between inbound and outbound BDRs. In 2024, BDRs reporting to Marketing spent less time on outreach compared to those reporting to Sales. However, this year, both groups report spending the same amount of time connecting with prospects.

It is worth noting that there is no reliable relationship between time spent contacting prospects and quota attainment. Simply dedicating more time to outreach efforts does not guarantee higher performance or better results.

This highlights the potential importance of factors such as the quality of outreach, effective targeting strategies, or other support mechanisms in driving success, rather than simply the quantity of time spent on prospecting efforts.

BDRs Hold Steady in Outreach Offerings

For the second year in a row, our research on the B2B buying journey confirms that most buyers don’t meet with a salesperson until they’ve already identified a preferred vendor. In over 80% of cases, buyers are simply validating their decision by the time they agree to speak with a seller, and they are unlikely to accept meeting requests earlier in their process.

Rather than pushing for a demo or discovery call before buyers are ready, BDRs and sellers should focus on enabling buying groups through education, insights, and resources that help them progress in their journey. Buyers won’t engage until they’re ready, so there is nothing to lose by shifting focus to being a value-adding partner.

Last year, we began asking BDRs how often they incorporate these kinds of value-driven activities into their outreach. Year over year, there is no change: BDRs still ask for meetings in about 70% of their contact attempts, and the top four activities are all about achieving a goal the BDR has, not about enabling buyers. Value-adding activities such as offering educational content and strategy sessions with subject-matter experts occur in half or fewer of contact attempts.

There are no statistically reliable differences year-over-year in the percentage of BDRs engaging in these individual activities. Nearly all BDRs are incorporating some level of value-added content into their outreach — a promising sign. However, we would like to see the emphasis continue to shift toward value-add approaches.

We recognize that the core responsibility for BDRs remains achieving quotas and meeting KPIs, such as securing meetings. Yet, our Buying Experience Research makes it clear that buyers simply do not engage unless and until they are ready. This calls for a shift in how marketing and sales approach their potential buyers. We hope revenue teams will adapt to this landscape sooner rather than later.

BDR Performance

Performance Expectations

When a market experiences a slump as B2B has in 2023 and 2024, selling organizations operating in that market often lower or at least do not raise BDR quotas. This helps make goals more attainable for BDRs, buttressing BDR motivation. In the summer of 2022, economic concerns began to dominate B2B discussions, fueled by news of tech layoffs, inflation challenges, and the collapse of Silicon Valley Bank, alongside growing fears of a looming U.S. recession.

In response to these conditions, we asked BDRs whether their organizations had increased, decreased, or maintained quotas. Over the years, most organizations have tended to maintain or increase quotas, with fewer than 10% of respondents reporting decreases. However, this year, a notably higher percentage—13% of our sample—reported a decrease in quotas. While most organizations continue to maintain (over 50%) or increase quotas (35% in 2025), this finding suggests that there has not been an increase in confidence in B2B entering 2025.

BDRs Achieve 88% of Quota, On Average

This year, BDRs reported achieving 88% of their quota targets. Quota attainment in 2025 is statistically higher than in 2022; however, no other differences in the chart below are statistically reliable. This suggests overall stability in quota attainment over the past several years, with an improvement since 2022.

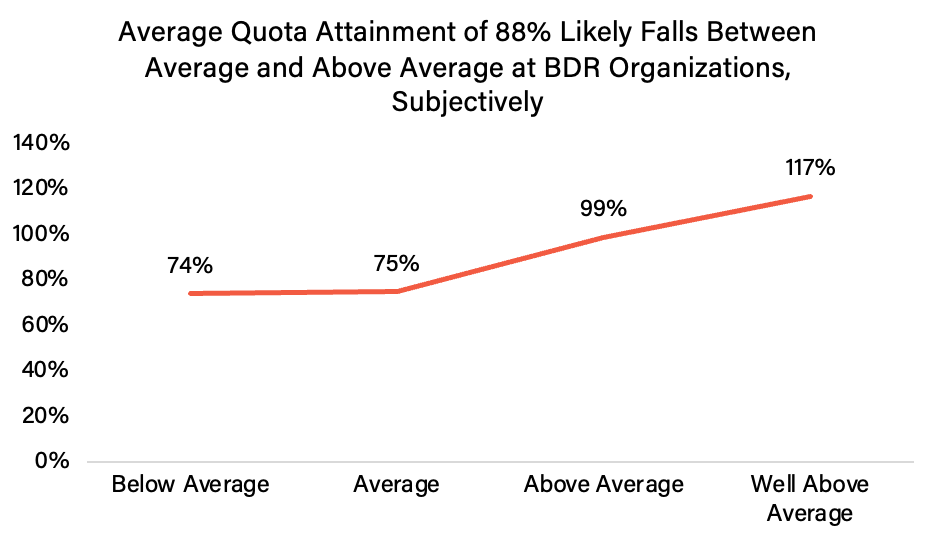

In addition to asking BDRs about their raw quota attainment, we also asked them to indicate whether they perceive their performance as above or below average compared to their peers within their organization. On average, BDRs who perceived their attainment as “average” reported a quota attainment of 75%, while those who perceived their attainment as “above average” reported nearly 100%. This suggests that the overall average quota attainment of 88% is likely viewed positively within BDR organizations, falling between the perceptions of “average” and “above average.”

Supported BDRs Are the Highest Achievers

Each year, our data show that BDRs who receive the highest levels of on-the-job support—measured by our Support Index (explained further here)—consistently report the highest levels of quota attainment. For the fourth year in a row, we find the same pattern. This year, BDRs who Agree or Strongly Agree on the Support Index report 95% quota attainment, compared to 80% for those who score lower—a substantial difference.

Among the four dimensions of our Support Index, the strongest link to performance is BDRs feeling they have clear expectations in their role. This is followed by having the tools, training, and equipment needed to do their job, a belief that being a BDR will help advance their career, and finally, feeling supported by leadership.

Multi-Threading and AI to Help Drive Quota

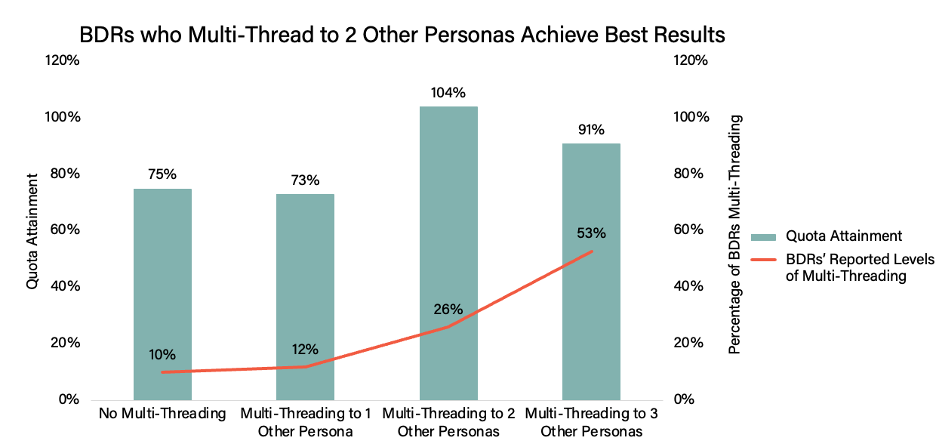

Earlier in this report, we noted an increase in the number of BDRs multi-threading, from 83% in 2024 to 90% in 2025. Not only are more BDRs adopting this approach, but many are doing so more thoroughly. While most BDRs in 2024 followed up with just one additional persona, the majority in 2025 (53%) now follow up with three additional personas.

How does multi-threading translate to performance?

BDRs who follow up with two additional personas report an average quota attainment of 104%. This is statistically higher than those who follow up with just one persona, but not reliably different from those who follow up with three or more personas.

If possible, BDRs should aim to follow up with at least two additional personas during their multi-threading efforts. Encouragingly, nearly 80% of BDRs are doing this in 2025.

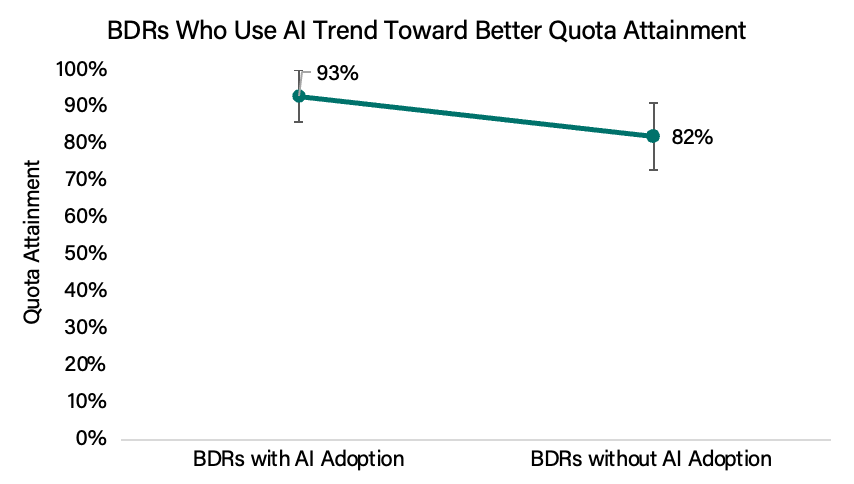

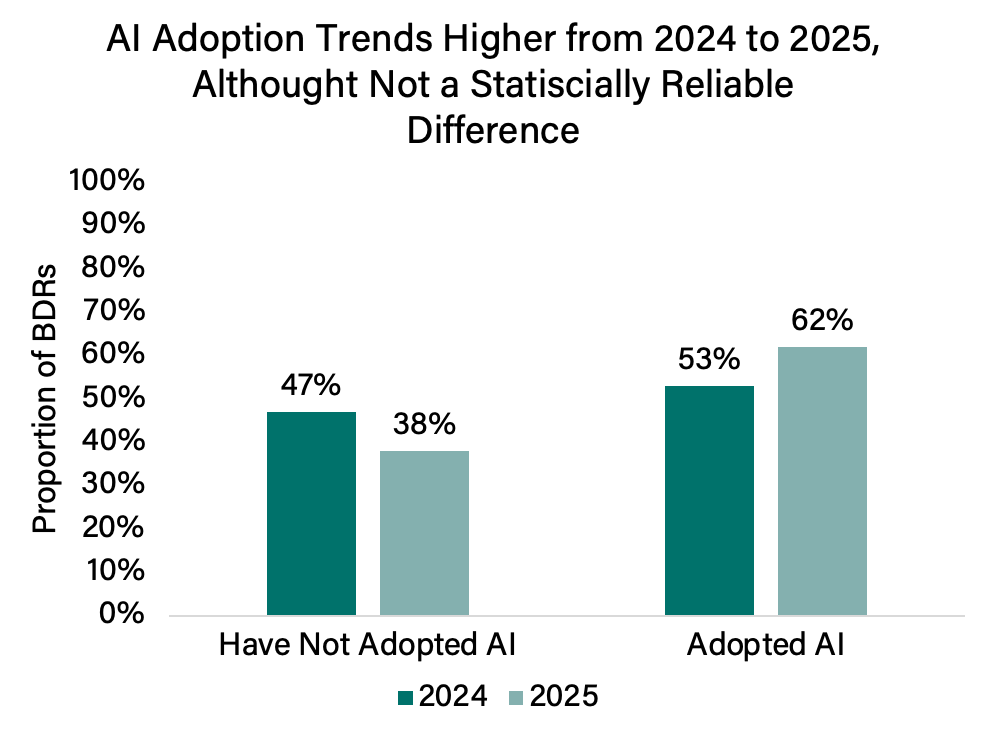

Later in the report, we will explore current AI adoption among BDRs, including which tools they use and their perspectives on integrating AI into their workflows. Before that discussion, we will examine quota attainment among those who have adopted AI versus those who have not.

The difference shown in the chart below approaches statistical reliability (p = .057) but does not meet the threshold. While not statistically reliable at the 95% confidence level, the trend is noteworthy: BDRs who leverage AI appear to outperform those who have not adopted it.

There are two possible explanations for this trend. It is possible that early-adopters of AI are organizations that invest in their BDR team’s performance more than other organizations, and AI is simply an indicator of that. Or it may be that the AI applications themselves are creating an advantage. We will continue monitoring this trend in the future.

How BDRs Perceive Their Role

BDR Support Index

Each year, we include four items from the acclaimed Gallup Employee Engagement Survey. The Gallup survey is often used in academic and professional research to assess employee engagement. Respondents rate the four items in our survey on a scale from Strongly Agree (7) to Strongly Disagree (1). When taken together, they form what we refer to as the Support Index, serving as an overall measure of how supported BDRs feel in their roles. Each item in the Support Index is listed below.

| Survey Question | What the item measures |

| I know what is expected of me in my role. | I know what to do. |

| I have the tools, training, and equipment to do what is expected of me in my role. | I believe I can do it. |

| Leadership of my company believes my role is highly valuable. | What I do matters to others/is important. |

| I believe my experience in this role will help me advance my career. | What I do matters to me. |

Overall, support scores have remained high since we began tracking them in 2022. On a scale from Strongly Agree (7) to Strongly Disagree (1), the Support Index has typically averaged around 6, or “Agree,” indicating that most BDRs feel supported in their roles.

In recent years, however, there has been a slight dip in the Support Index, with scores falling just below 6—5.8 in 2024 and 5.9 in 2025. It is encouraging to see the score stabilize since 2024, though we’d love to see it return to a 6 or higher.

Leadership Support and Adequate Tooling Weigh on Supported Scores

For the second consecutive year, BDRs report that they know what is expected of them and feel confident that their current role contributes to their career goals. However, the Support Index shows that BDRs come up short of agreeing that they have the leadership support, tools, training, and equipment to succeed. BDRs who do not feel they have what they need to succeed simply don’t succeed as well as those who do.

The Tools BDRs Need to Feel Supported: Contact & Intent Data

For the third consecutive year, BDRs have identified contact data as the resource that would make them feel most enabled. Contact data was rated statistically higher than any other resource. Intent data and account data ranked second, with no statistically reliable difference between them. However, both were rated reliably higher than the remaining resources.

In the figure below, each box represents resources with statistically reliable differences in ratings. Resources grouped within the same box indicate that there is no statistically reliable difference in how BDRs rated them.

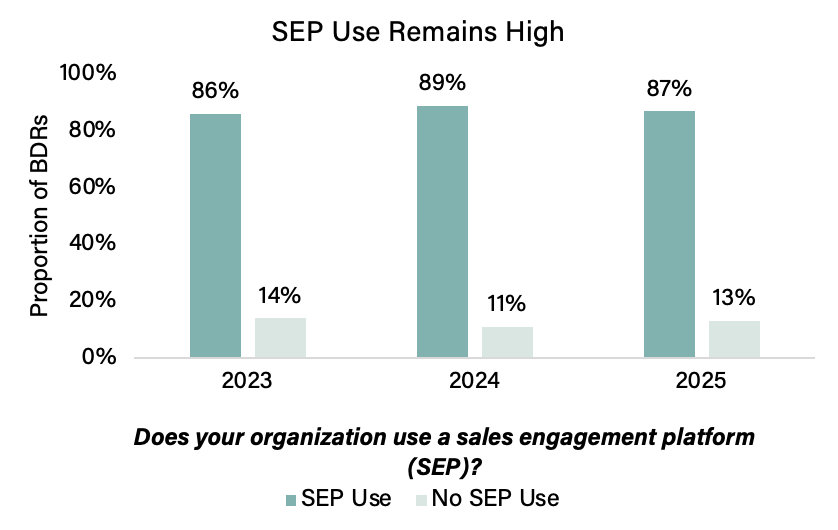

The Evolving Role of Sales Engagement Platforms (SEPs)

For the first time since we began surveying BDRs in 2022, the use of a Sales Engagement Platform (SEP) was not associated with higher Support Index scores. In prior years, we consistently found that SEP use was linked to higher Support Index scores, particularly on the tools dimension of the index. BDRs who were provided an SEP felt more supported and performed better. It may be that the presence of this tool is now simply considered a given.

Artificial intelligence (AI)

Over the past few years, AI has experienced explosive growth, with massive advancements in both its development and accessibility. Tools like AI agents, email writing tools, and automated buyer engagement tools have become more widely available, offering significant potential to help BDRs streamline and personalize key aspects of their role. These tools promise to automate time-consuming tasks, such as lead qualification and follow-up emails, while also enabling BDRs to deliver more tailored and impactful outreach.

In this section, we will explore how many BDR organizations have embraced AI, examine their perspectives on the current state of AI technology, and uncover their aspirations for AI integration in the future. By understanding both the adoption and sentiment surrounding AI, we can better grasp its transformative impact on the BDR profession and its evolving role in sales enablement.

Adoption

Last year, just over half of the BDRs we surveyed (53%) reported that their organizations had adopted at least one AI tool into their suite of tools. This year, that number has risen to 62%. The increase is not statistically reliable (falling just short of the 95% confidence threshold with a p-value of .067), however. This suggests that marketplace buzz about AI tools is not entirely matched by real-world implementation, though the trend is in that direction.

Most BDRs Believe AI Helps Make Their Role More Productive

BDRs view AI positively, with 62% stating that AI tools make their role more productive. However, not all BDRs see AI as impactful at this stage—25% believe it is not yet a meaningful factor in their day-to-day work. A smaller portion, 13%, view AI as a potential threat to the future of their role. It is worth noting that just a small minority of BDRS view AI as a threat, that small minority has increased in size by 50% year over year.

BDRs’ opinions on AI have remained largely consistent since last year (see below).

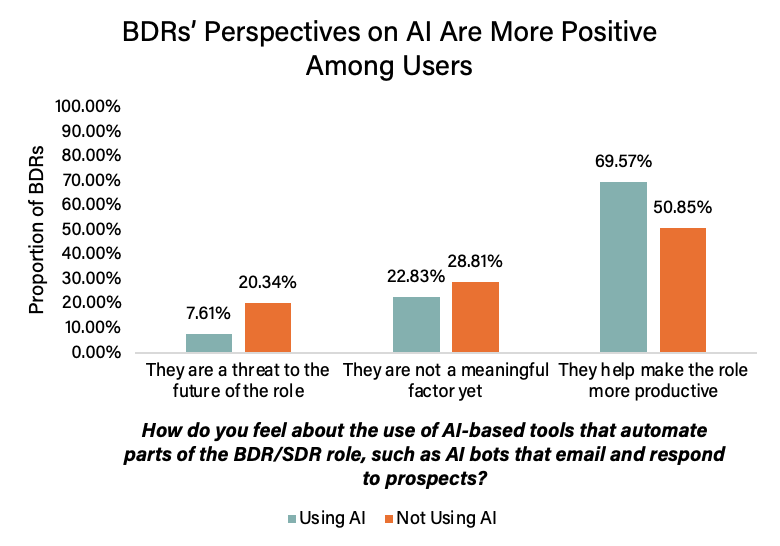

Experience Divide

Among non-adopters, 20.3% perceive AI as a threat to the future of their role, compared to just 7.6% of adopters. This disparity suggests that non-adopters may harbor concerns about job displacement or the potential negative impacts of automation. Conversely, a significant portion of adopters (69.6%) believe AI enhances productivity, a sentiment shared by a lower percentage (50.8%) of non-adopters.

These results imply that firsthand experience with AI may help alleviate fears and foster a more optimistic view of its potential to support and enhance roles rather than replace them.

To further explore BDRs’ perspectives on AI, we asked what role they envision AI playing in their work—ranging from minimal involvement to AI taking on a larger share of routine tasks. Among non-AI adopters, the majority (54.2%) prefer limited integration, suggesting a cautious approach to AI, potentially due to unfamiliarity or skepticism about its capabilities.

In contrast, adopters show a stronger inclination (54.3%) toward moderate integration, reflecting greater confidence in AI’s ability to handle routine tasks effectively.

These finding suggest the role of experience in shaping attitudes toward AI. Firsthand exposure to AI’s benefits appears to leave adopters more comfortable with deeper integration, while non-adopters remain hesitant, perhaps due to a lack of understanding or perceived risks.

Which AI Tools Are BDRs Using?

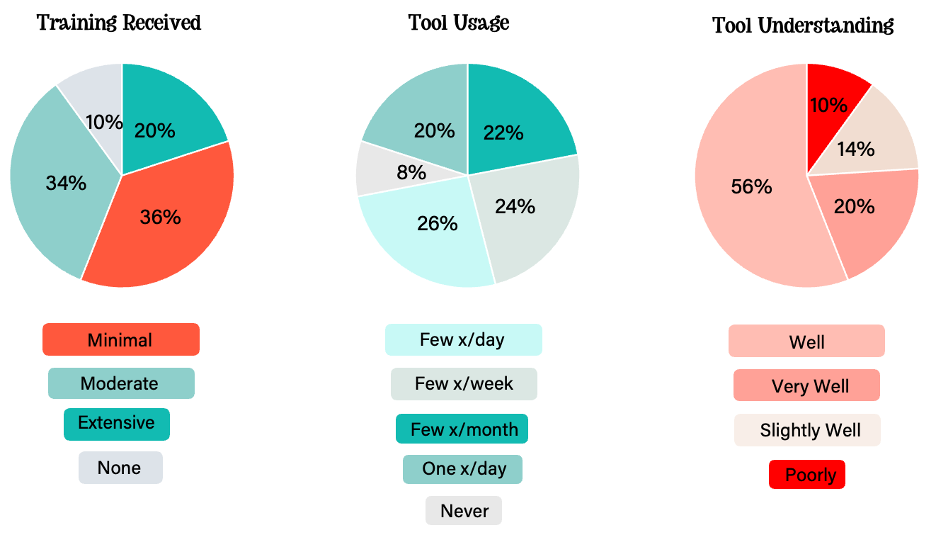

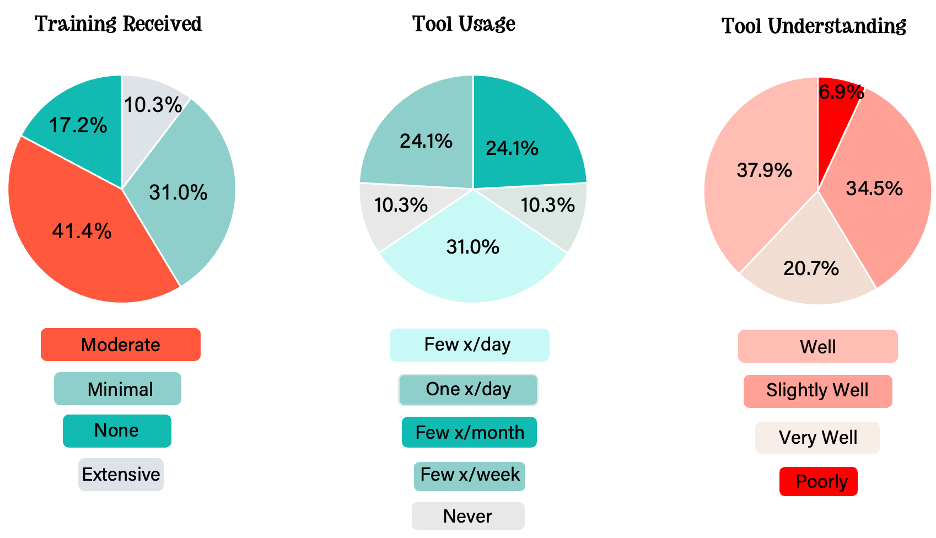

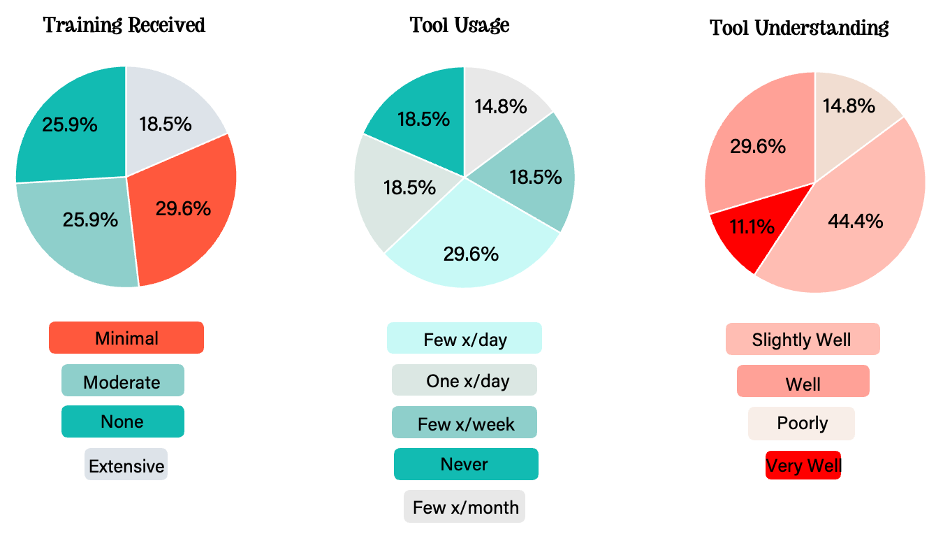

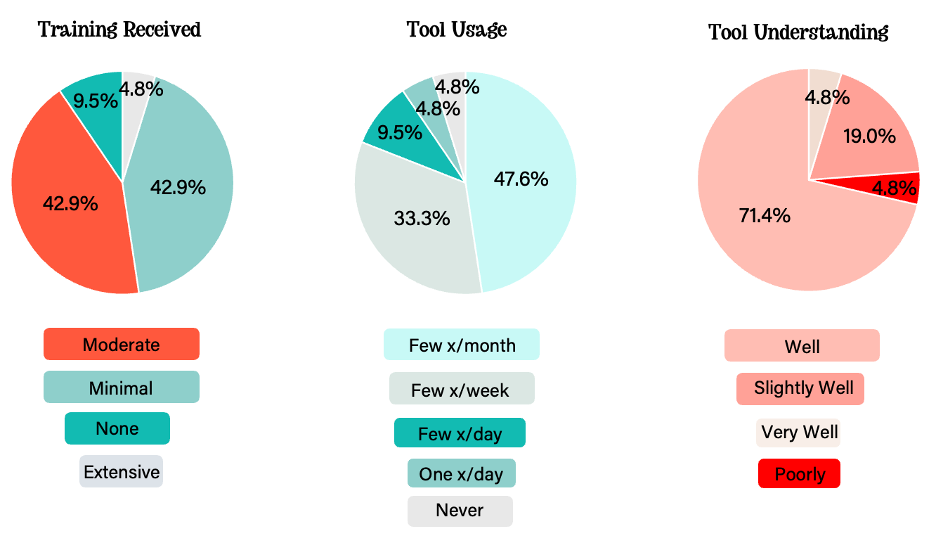

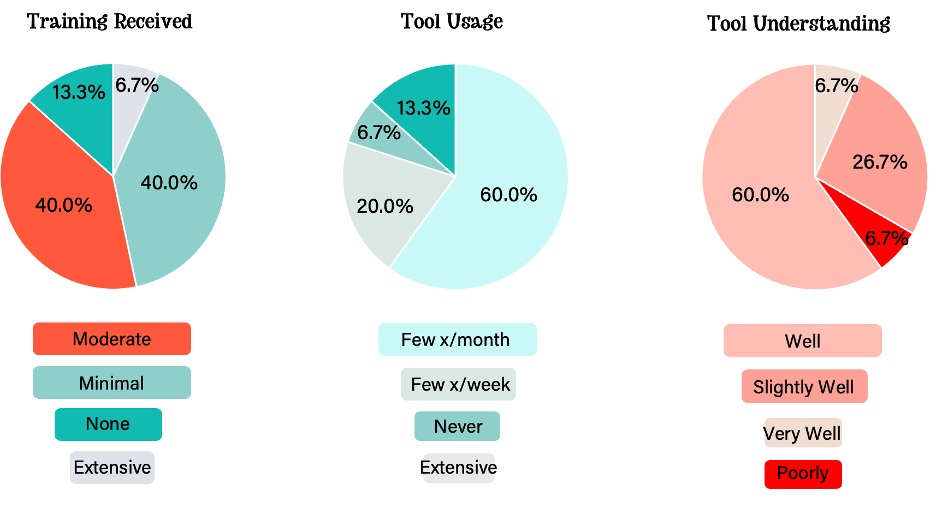

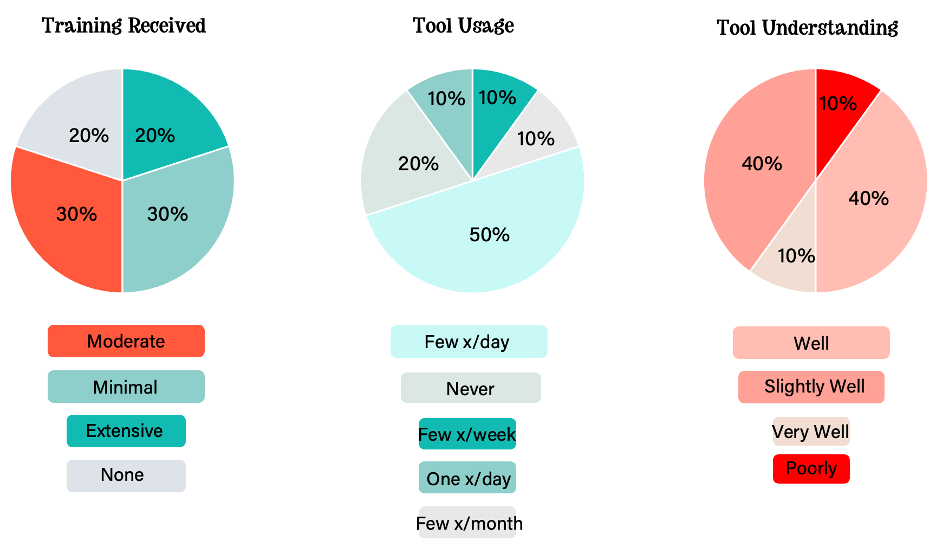

We asked BDRs to tell us which they use from a list of seven AI tools. Like last year, AI-powered email writing tools and AI-based call transcription remain the most widely adopted. Training on these tools also shows little change: last year, most BDRs reported receiving minimal (38.5%) or moderate (33%) training, a trend that has largely continued this year. Below, we break down the seven tools we asked about, examining the training BDRs report receiving for each, how frequently they use these tools, and how well they feel they understand their full capabilities.

AI Email Writing Tool

What is it? A tool that generates, optimizes, or personalizes email drafts based on the prospect’s data, preferences, and previous interactions.

Most BDRs receive moderate (42%) or minimal (29%) training for AI email writing tools, use it a few times per week (31.8%) or a few times per day (28.8%), and understand its full capabilities well (45%) or very well (23%).

AI-based Call Transcription

What is it? A tool that transcribes call conversations into text using AI, often including keyword recognition and sentiment analysis.

Most BDRs receive minimal (36%) training for AI call transcription tools, use them a few times per day (26%) or a few times per week (24%), and understand its full capabilities well (56%).

Automated AI Email and Response Tool

What is it? A system that automates sending follow-up emails and responding to prospect replies using AI to maintain natural, conversational tones.

Most BDRs receive moderate (41.4%) training for automated AI email and response tools, use them a few times per day (31%), and understand its full capabilities well (37.9%) or slightly well (34.5%).

AI Agents

What is it? AI-powered virtual assistants or chatbots that engage with prospects via voice or text to qualify leads or answer basic inquiries.

Most BDRs receive minimal (29.6%) training for AI Agents, use it a few times per day (29.6%), and understand its full capabilities slightly well (44.4%).

AI-based Call Coaching

What is it? A tool that analyzes call recordings and provides feedback on areas like tone, pace, word choice, and overall effectiveness.

Most BDRs receive minimal (42.9%) or moderate (42.9%) training for AI-based call coaching, use it a few times per month (47.6%), and understand its full capabilities well (71.4%).

AI-based Role-playing/Call Simulation

What is it? A training tool that uses AI to simulate sales calls, allowing BDRs to practice their skills in a risk-free environment.

Most BDRs receive minimal (40%) or moderate (40%) training for AI-based role-playing/call simulation, use it a few times per month (60%), and understand its full capabilities reasonably well (60%).

AI-based Calling

What is it? A tool that uses artificial intelligence to prioritize calls, suggest optimal times for outreach, or provide live assistance during calls, such as generating talking points based on the prospect’s profile.

Most BDRs receive minimal (30%) or moderate (30%) training for AI-based calling, use it a few times per day (50%), and understand its full capabilities well (40%) or slightly well (40%).

Implications for BDRs in 2025

For more than a year, there have been storm clouds on the horizon for B2B BDRs and SDRs. Rumors of the demise of the function – whether due to changing beliefs about its contribution to revenue production, or the threat that AI will replace humans in the function – have been rampant.

On the ground, however, life has gone on much as before.

Eighty percent of BDR teams have either grown or maintained their size, while also continuing to achieve quota at a high rate (88%). Perceived support has stabilized — crucial as supported BDRs outperform peers by 15%. And BDRs are adopting more modern, buyer-centric practices: multi-threading and value-driven engagement have increased, with top BDRs engaging more buying group members and diversifying tactics beyond meetings. However, for smaller deals, there is already excessive multi-threading. BDR teams should meter the number of individuals they attempt to reach based on the potential size of the deal and the buying group.

We applaud the trend toward buyer-focused engagement. Buying group members won’t take meetings until they are ready (see our research describing this). Providing buyer-enabling content can nudge readiness, while focusing on getting meetings risks alienating in-market buyers.

BDR teams are increasingly moving back under sales, focusing on outbound rather than inbound. This is fine if they focus on identifying and enabling buying group members. However, reporting to sales may lead to a focus on more readily measurable but flawed outcomes like meetings booked. We will monitor these trends.

As expected, AI adoption is rising, with 62% of teams using at least one AI tool. However, many AI tools are being marketed as replacements for some or all of BDR jobs. Real-world implementations have been focused on tools that enhance, rather than replace BDR efforts. As and when enhancing tools are overtaken by replacement-level tools, BDR sentiment toward AI will likely change.

There are still storm clouds on the horizon for BDRs. When or if those clouds begin to impact local conditions for BDRs remains to be seen. For now, BDRs still see AI as a benefit, and BDR teams are maintaining their critical role within revenue organizations.

Survey Sample

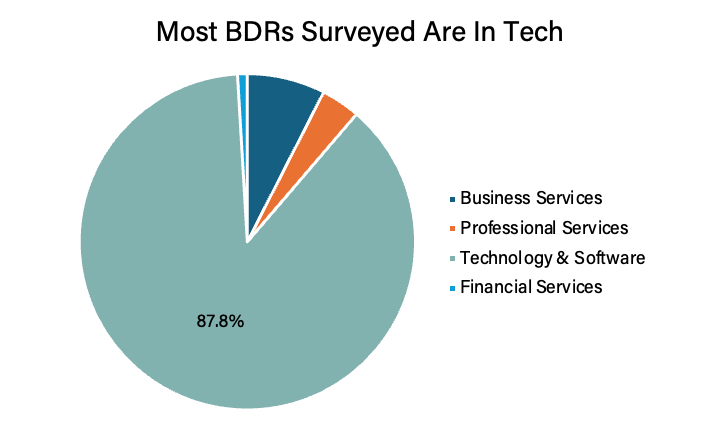

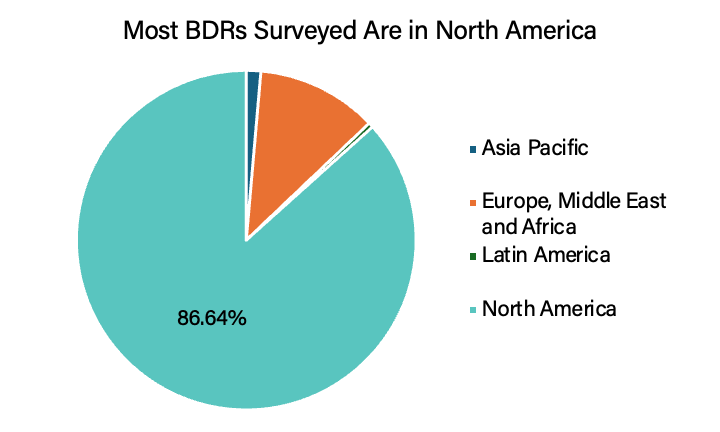

We surveyed 262 BDRs for this analysis. Participants were sourced through the 6sense platform and social media. Most (88%) BDRs we surveyed to are in Technology & Software and 87% work in North America.